The Evolution of FinOps: Streamlining Financial Operations in the Cloud Era

In the rapidly evolving world of cloud computing, the traditional methods of financial management and operations are being challenged. The emergence of FinOps—short for Financial Operations—marks a significant shift in how organizations approach financial governance in the cloud. This article delves into the fundamentals of FinOps, its key benefits, and best practices for successful implementation.

What is FinOps?

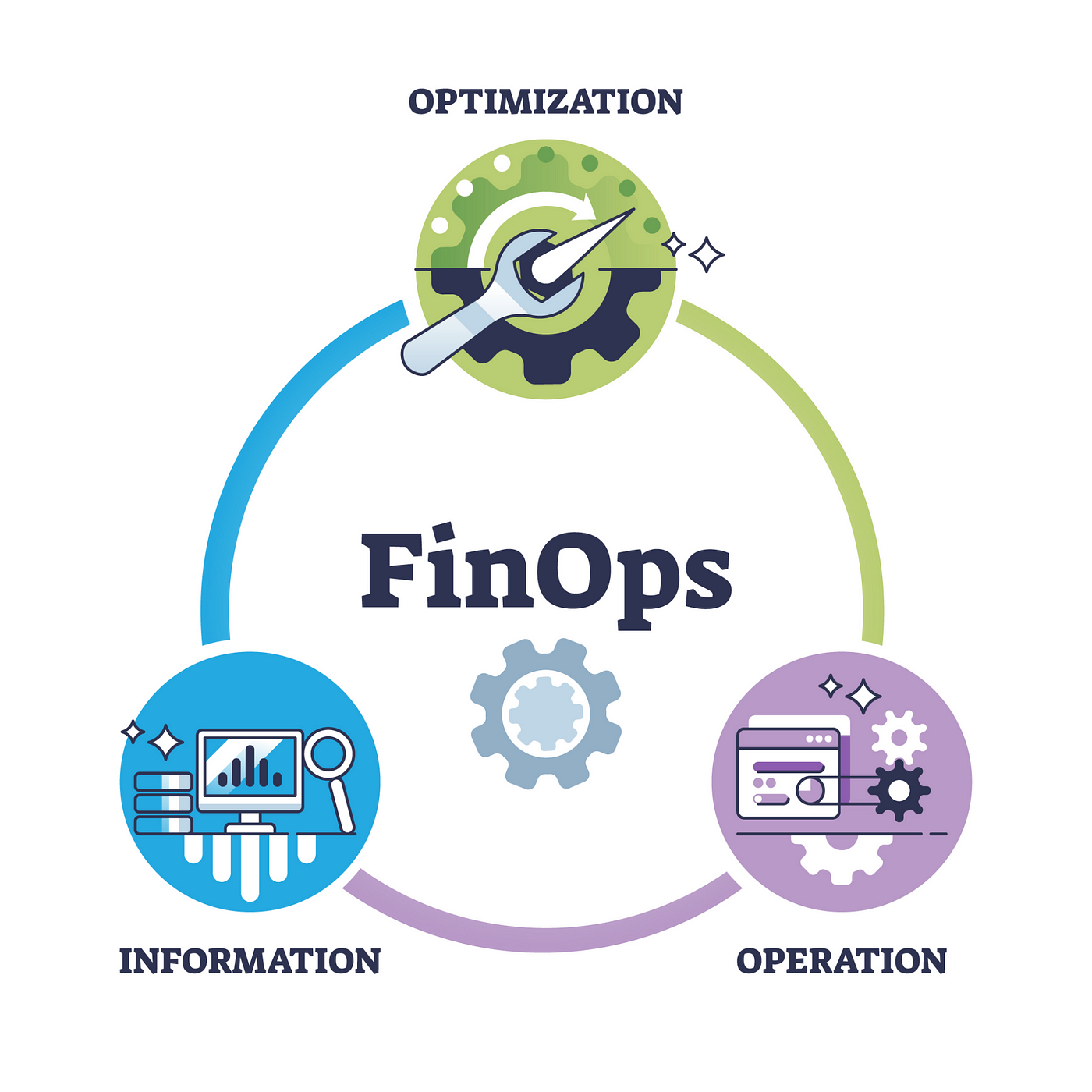

FinOps is a set of practices and cultural philosophies designed to manage and optimize cloud financial operations. It integrates financial accountability into the cloud’s agile environment, allowing organizations to maximize the value of their cloud investments while controlling costs. Unlike traditional finance practices, which can be rigid and retrospective, FinOps is iterative, collaborative, and forward-looking, reflecting the dynamic nature of cloud resources and pricing.

The Rise of FinOps

As organizations increasingly adopt cloud services, they face new challenges in managing costs and financial efficiency. The pay-as-you-go model of cloud computing, while flexible, can also lead to unpredictable spending and inefficiencies. Traditional financial management systems and practices, often optimized for on-premises infrastructure, struggle to keep pace with the agility and scale of the cloud.

FinOps emerged to bridge this gap, combining financial governance with the flexibility and speed of cloud environments. By fostering a culture of collaboration between finance, operations, and engineering teams, FinOps enables more strategic and informed decision-making.

Key Benefits of FinOps

Cost Optimization: FinOps practices help organizations monitor and analyze cloud usage, identify cost-saving opportunities, and implement cost control measures. By tracking spending patterns and setting budgets, organizations can avoid overspending and better allocate resources.

Improved Visibility: FinOps provides enhanced visibility into cloud expenditures. With detailed reporting and forecasting, finance teams can gain insights into spending trends, budget adherence, and the financial impact of cloud initiatives.

Enhanced Collaboration: FinOps fosters collaboration between finance, engineering, and operations teams. This cross-functional approach ensures that all stakeholders are aligned on financial goals, cloud usage policies, and cost management strategies.

Agility and Flexibility: As cloud environments are inherently dynamic, FinOps supports agile financial management. It allows organizations to quickly adapt to changing cloud usage patterns and market conditions, ensuring that financial strategies remain relevant and effective.

Data-Driven Decision Making: By leveraging data and analytics, FinOps enables organizations to make informed decisions about cloud investments and resource allocation. This data-driven approach helps optimize spending and drive business value.

Best Practices for Implementing FinOps

Establish Clear Objectives: Define the goals of your FinOps initiative. Whether it’s reducing cloud costs, improving budgeting accuracy, or enhancing financial visibility, having clear objectives will guide your strategy and efforts.

Build a Cross-Functional Team: Form a FinOps team that includes members from finance, engineering, and operations. This team should work together to develop and enforce cloud cost policies, analyze spending patterns, and optimize resource usage.

Implement Cloud Cost Management Tools: Utilize cloud cost management and optimization tools to gain insights into spending and usage. These tools can provide detailed reports, forecasts, and recommendations for cost savings.

Foster a Culture of Accountability: Encourage a culture where all stakeholders take ownership of their cloud usage and associated costs. Promote transparency and open communication to ensure that everyone is aligned with financial goals and policies.

Continuously Monitor and Adjust: FinOps is an ongoing process. Regularly review and adjust your financial strategies based on changing cloud usage patterns, new technologies, and evolving business needs. Use data and feedback to refine your approach and improve cost management.

Educate and Train Teams: Provide training and resources to help teams understand cloud cost management practices and tools. Ensuring that everyone is knowledgeable about FinOps principles and techniques will enhance the effectiveness of your financial operations.

Conclusion

FinOps represents a paradigm shift in managing financial operations in the cloud era. By integrating financial management with the dynamic nature of cloud computing, FinOps enables organizations to optimize costs, improve visibility, and foster collaboration. Embracing FinOps practices can lead to more efficient financial operations and better alignment with business objectives, ultimately driving greater value from cloud investments.

As the cloud landscape continues to evolve, organizations that adopt FinOps principles will be better equipped to navigate the complexities of cloud financial management and achieve sustainable growth.